What is Nonprofit Bookkeeping?

- Chris Musser

- Apr 7

- 2 min read

Understanding “Full Charge Bookkeeping” for Nonprofits

If you run a nonprofit, you already know: the bookkeeping isn’t just about balancing the checkbook. It’s about accountability to your mission, your funders, your board, and the IRS.

Nonprofit bookkeeping includes day-to-day accounting task, plus the monthly, quarterly, and annual responsibilities that keep your organization compliant and audit-ready.

📌 Core Responsibilities

Recording every receipt, bill, check, credit card charge, and bank transfer.

Preparing and posting journal entries for accurate, audit-ready books.

Reconciliations of all bank and balance sheet accounts each month.

Processing accounts payable and receivable, including proper coding for restricted and unrestricted funds.

Recording donations, including correct allocation of donated service fees.

Assisting with payroll processing, and ensuring payroll expenses are properly allocated across grants and functional expense categories.

🎯 Expense Allocation: The Heart of Nonprofit Accounting

Nonprofit bookkeeping requires a deeper level of tracking and categorization than most for-profit businesses—especially when it comes to functional expense reporting.

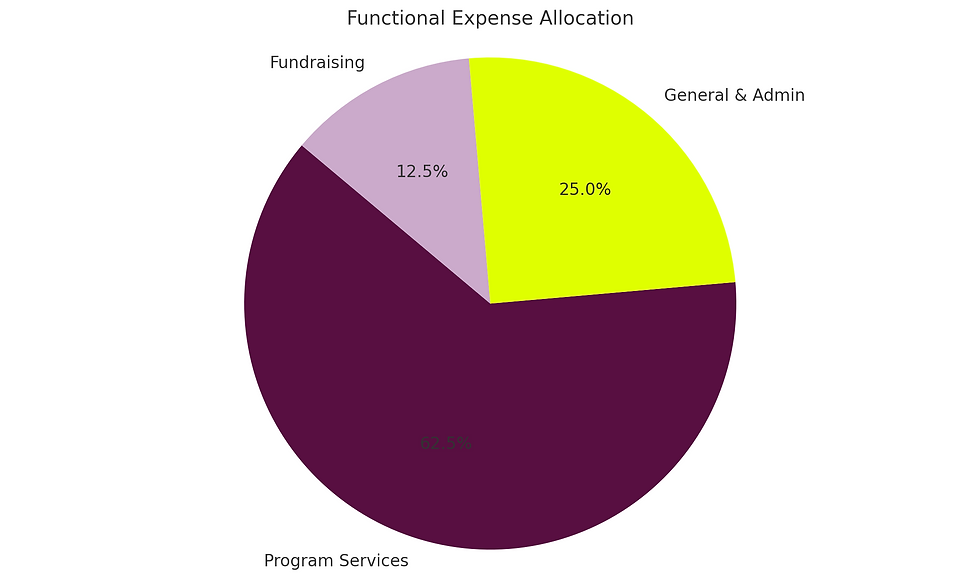

You can read more about allocating functional expenses here, but the short version is: all expenses must be categorized by function. There are three categories used in your annual financial reports and your IRS Form 990:

Program services

General and administrative

Fundraising

That means every salary, office supply, event rental, or consultant fee needs to be tracked not just by type, but also by purpose.

Payroll, in particular, must be carefully allocated—especially when a staff member works on multiple programs or straddles program and admin work. Their time (and wages) need to be assigned according to the actual impact on restricted funds and functional areas.

🧾 Why This Matters

Funders, board members, and watchdog organizations all want transparency—and so does the IRS. That’s why your books need to be clean, complete, and categorized correctly. An experienced nonprofit bookkeeper doesn’t just “enter the numbers”—they help ensure:

Compliance with nonprofit accounting standards

Accurate grant tracking and reporting

Smooth audits and 990 preparation

Better decision-making for your leadership team

If you're looking for someone who understands the why behind every journal entry—and has the skills to get them right—I'd love to help. I work with Portland-based nonprofits to create financial clarity, one transaction at a time.

Comments